vehicle sales tax san antonio texas

The December 2020 total local sales tax rate was also 8250. If the seller does not transfer or keep their license plates the license plates must be disposed of by defacing the front of the plates either with permanent black ink or another method in order.

Lawmakers Back Away From Sales Tax Increase

5910 Amber Rose San Antonio TX 78253 524000 MLS 1600341 Welcome to this gorgeous neighborhood.

. The minimum combined 2022 sales tax rate for San Antonio Texas is. The Finance Department is responsible for collecting the fees for various taxes. Texas has a statewide sales tax of 625 that applies to all car sales.

Texas collects a 625 state sales tax rate on the purchase of all vehicles. PersonDepartment. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

If you purchased the car in a private sale you may be taxed on the. Local and county taxes are also applied to car sales and add about another 167 to the price of your. Application for Certified Copy of Title VTR-34 Application for Texas Title andor Registration Form-130-U Change of Address for Texas Motor Vehicle VTR-146 Detailed Instructions for.

City of San Antonio Attn. Albert Uresti MPA Physical Address. Registration Renewals License Plates and Registration Stickers.

This is the total of state county and city sales tax rates. Box is strongly encouraged for all incoming mail. 233 N Pecos La Trinidad San.

The sales tax jurisdiction. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. All Forms Tax Vehicle Property Taxes - Applications and Forms.

Monday - Friday 745 am - 430 pm Central Time. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase. In addition to taxes car purchases in Texas may be.

Sales and Use Tax. This County Tax Office works in partnership with our Vehicle Titles and Registration Division. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

San Antonio TX 78283-3966. Mailing Address The Citys PO. County tax assessor-collector offices provide most vehicle title and registration services including.

San Antonio has parts of it located within Bexar. Public Sale of Property PDF Bidder Request Form PDF Property Tax Frequently Asked Questions. 625 percent of sales price minus any trade-in allowance.

Bexar County Tax Assessor-Collector Office. A used car in Texas will cost 90 to 95 for title and license plus 625 sales tax of the purchase price. Vehicle registrations may also be renewed by mail.

This includes the rates on the state county city and special levels. Some dealerships may charge a documentary fee of 125 dollars. The current total local sales tax rate in San Antonio TX is 8250.

San Antonio TX 78205. Congratulations to San Antonios Fiesta texas comptroller glenn hegar made a stop at the University of Texas at San Antonios National Security Collaboration Center 9. Multiply the vehicle price after trade-in andor incentives by the sales tax fee.

The average cumulative sales tax rate in San Antonio Texas is 822. Send your renewal form and a photocopy of proof of insurance to. 4 beds 4 baths 3982 sq.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. What is the sales tax rate in San Antonio Texas. The minimum is 625 in Texas.

There is no applicable county tax. Terrific 4 bedroom and 4 bath home.

World Car Kia North San Antonio Tx New Used Kia Dealer

Brother S Auto Sales Llc Auto Dealership In San Antonio

Election To Reauthorize Sales Tax Funding Street Maintenance In Georgetown On November Ballot Community Impact

World Car Kia North San Antonio Tx New Used Kia Dealer

New Ford Dealership In San Antonio Tx Northside Ford San Antonio

What S The Car Sales Tax In Each State Find The Best Car Price

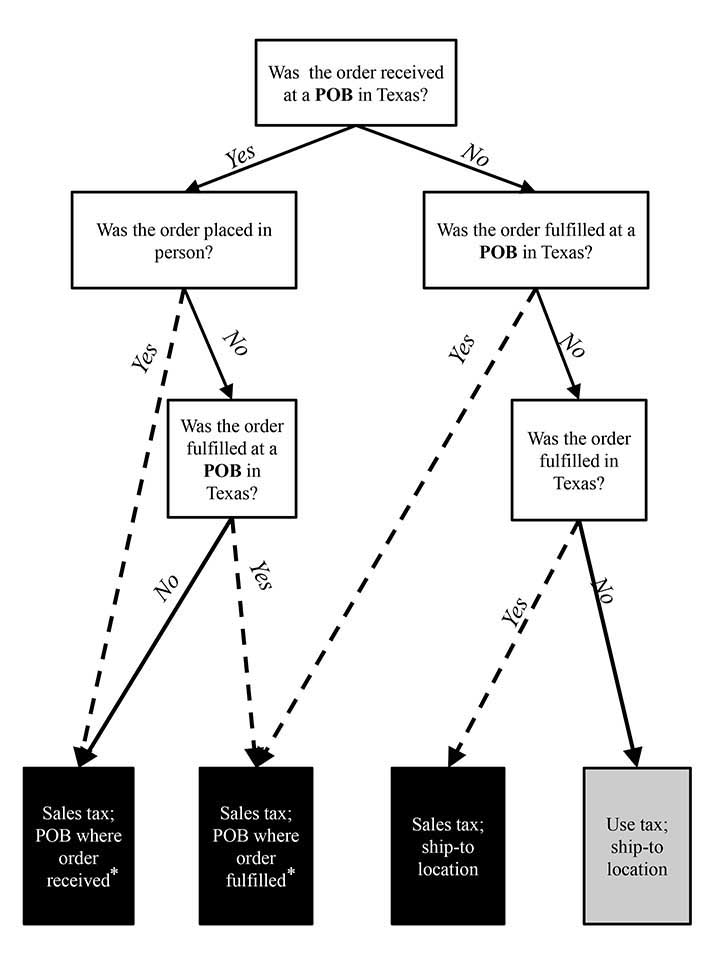

Local Sales And Use Tax Collection A Guide For Sellers

How Texas Spends Its Money How Texas Gets Its Money Why It Doesn T Add Up

Car Tax By State Usa Manual Car Sales Tax Calculator

Used Ford Flex For Sale In Salinas Ca Cargurus

2022 Texas Ev Trends Statistics To Know

Audi Dominion New Used Car Dealer In San Antonio Tx

Cent Sales Tax Archives San Antonio Report

Yes Texans Actually Pay More In Taxes Than Californians Do

San Antonio Auto Cars Magazine 1 06 2017 By Smart Media Solutions Llc Issuu