indiana inheritance tax exemptions

However that phase out was accelerated dramatically. Inheritance tax was repealed for individuals dying after December 31 2012.

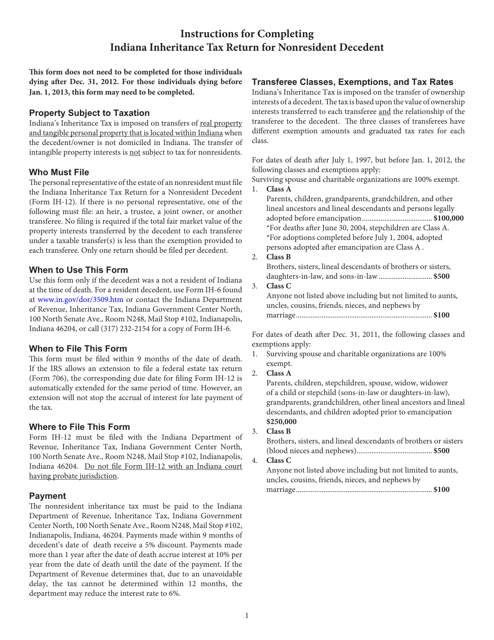

Indianas Inheritance Tax is imposed on transfers of real property and tangible personal property that is located within Indiana when.

. Although the State of Indiana did once impose an inheritance tax the tax. INHERITANCE TAX EXEMPTIONS AND DEDUCTIONS IC 6-41-3 Chapter 3. Indiana used to impose an inheritance tax.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate. How much money can you inherit without paying inheritance tax. Box 71 Indianapolis IN 46206-0071.

Class C beneficiaries had only a 100 exemption and the tax rates ranged from 10 to a 20. Last year the Indiana legislature enacted a plan to phase out Indianas Inheritance Tax by the end of year 2021. 2012 Indiana Code TITLE 6.

Code 6-41-3et seq. This means without an Indiana inheritance tax Indiana estates have to be greater than 525 million before any state or federal death taxes would be due. For example three siblings inheriting a 1 million parcel of land from a family friend had an.

Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. But just because the inheritance taxes didnt change in. In 2021 the credit will be 90 and the tax phases out completely.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Different exemption amounts and graduated tax rates for. Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7.

The IRS did however change the federal estate tax exemption from 2018 to 2019 from 1118 million to 114 million. Each heir or beneficiary of a decedents estate is divided into three classes. Inheritance Tax Exemptions and.

Do not file Form IH-6 with an Indiana court having probate. As of 2020 only six states impose an inheritance tax. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021.

The Inheritance Tax Return must be filed with the Indiana Department of Revenue PO. Indiana Inheritance and Gift Tax. For deaths occurring in 2013.

However other states inheritance laws may apply to you if someone living in a state with an. How much money can you inherit without paying inheritance tax. The affidavit may be used.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate. Indiana has a three class inheritance tax system and the exemptions and tax rates. Sandra would be responsible for paying the tax.

It may be used to state that no inheritance tax is due as a result of Decedents death after application of the exemptions provided by Ind. Each class is entitled to. This tax ended on December 31 2012.

There is no inheritance tax in Indiana either. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for. DEATH TAXES CHAPTER 3.

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis Estate Planning Attorneys

Dor Unemployment Compensation State Taxes

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

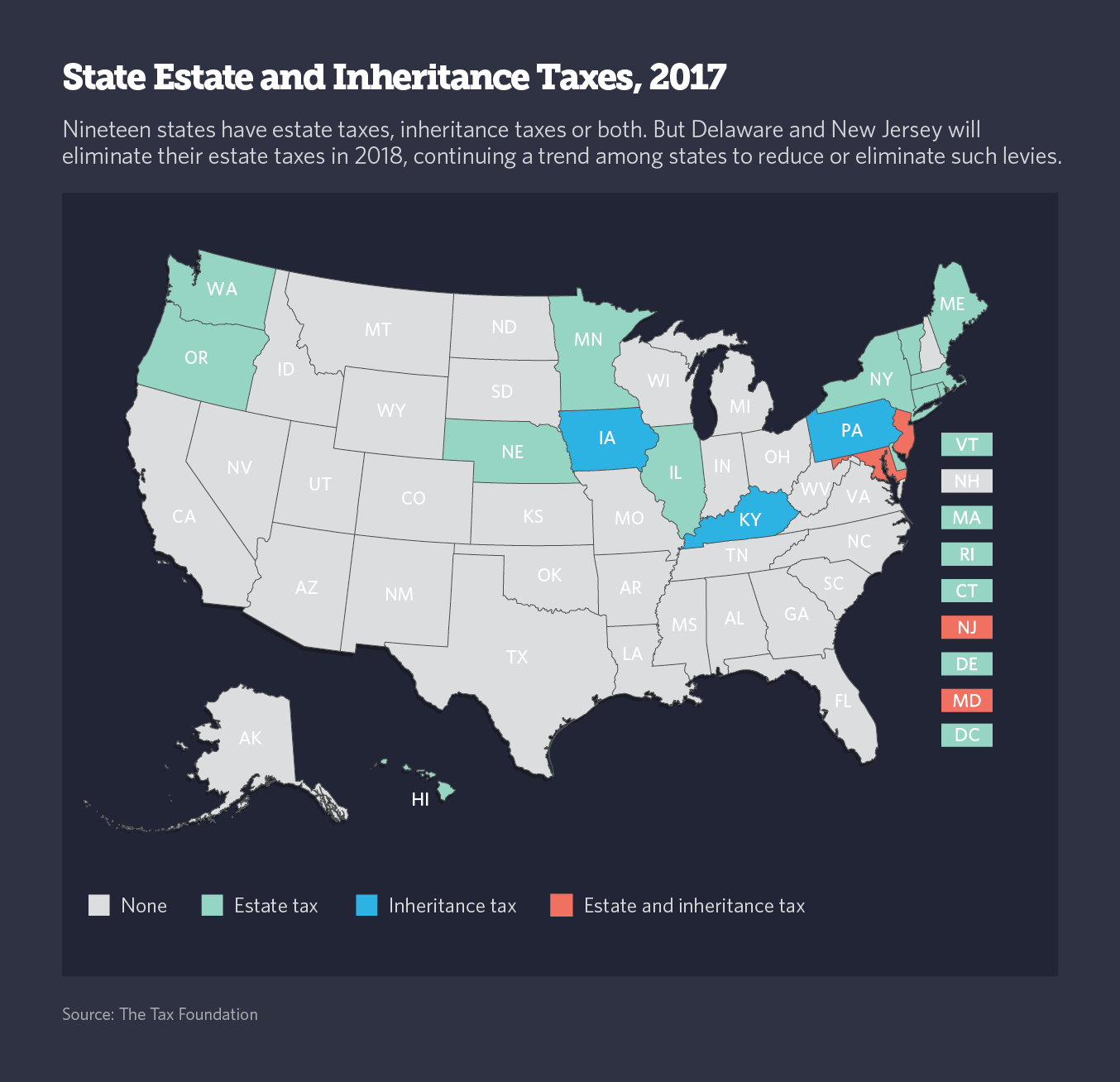

In States The Estate Tax Nears Extinction The Pew Charitable Trusts

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Planning Vick Law P C

Download Instructions For Form Ih 12 State Form 51492 Indiana Inheritance Tax Return For A Non Resident Decedent Pdf Templateroller

Estate And Inheritance Tax State By State Housing Gurus

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How Inheritance Tax Works Howstuffworks

The Potential For Major Estate Tax Changes During The Biden Administration What You Need To Know Inside Indiana Business

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die